How it Works

To achieve true financial health, you need the pros + the platform

Personal Finance Manager

You’ve been matched with Ron!

- LifeStyle Plan certified

- Certification from a 3rd party

- Driven by your success

- Can meet with you on a regular basis

- Can conduct video conference calls with you remotely

- 12 years experience working with clients

Put a face to your finances with a Personal Finance Manager hand-picked for you based on your needs. They do all the hard work for you and will lead you through our 7 steps to financial wellness.

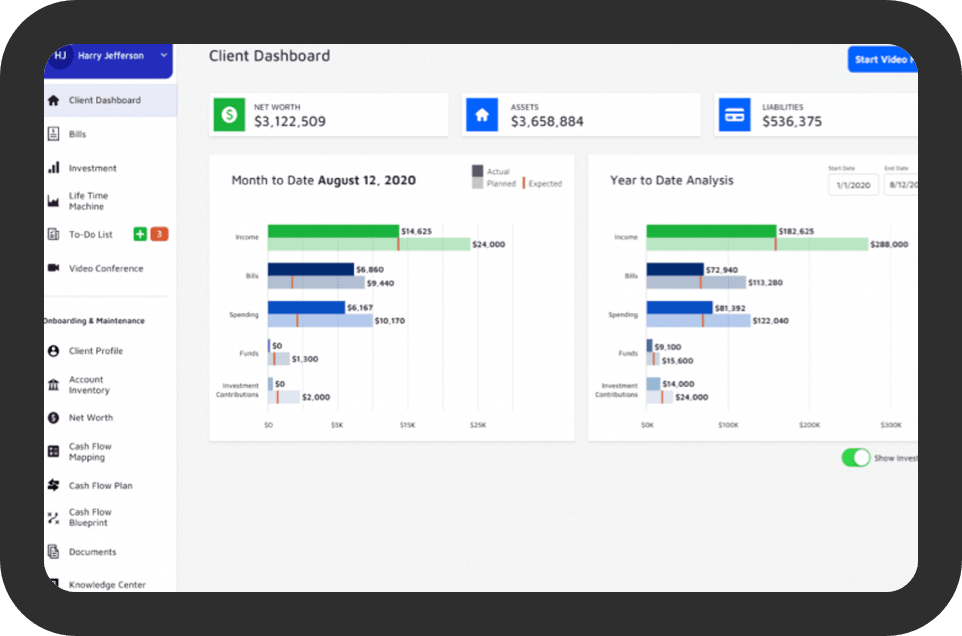

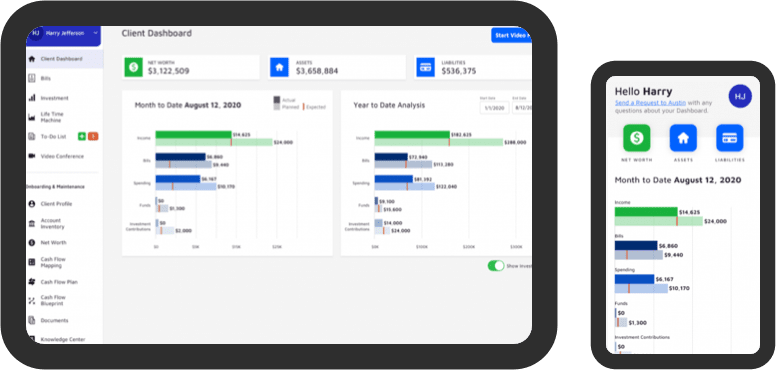

The Ultimate Platform

This is where your financial story takes shape. Our easy to use, dynamic platform helps you visualize your cash flow, investments, savings and more, giving you and your Personal Finance Manager insights that will help you achieve success.

Compare to see why it pays to have a Plan

| Features | Free Apps Like Mint | Financial Planners | |

|---|---|---|---|

| Mobile application | |||

| Ability to connect financial institution accounts | |||

| Ability to create a budget | |||

| Visibility to all transactions | |||

| Ad Supported | |||

| Incentivized to sell you other products | |||

| Ability to recommend investment strategy | |||

| Professional and client access | |||

| Ability to tie expenses to assets/investments to track performance | |||

| Dedicated professional to meet with you regularly to ensure goal achievement | |||

| Forecasting model to show your future based on all finance’s assets & liabilities | |||

| Live technical support | |||

| Account structure optimization | |||

| Personalized account onboarding | |||

| Built-in zoom integration | |||

| Ability to collaborate directly with an expert in the platform |

Every good plan has a process. Here’s ours.

Step one: Take an account inventory

We start by taking a look at everything you own and everything you owe. Connect all of your electronic accounts and see your complete financial picture in one place. Your Personal Financial Manager will help you create this list and enter the details.

Everything you own:

Real estate, investment accounts, retirement accounts, cars, business interests, annuities, jewelry – anything that has current and future value to you.

Everything you owe:

Mortgages, car loans, credit cards, money you owe your brother – anything that you are making payments on or will need to pay back at some point in future.

Step two: Find your net worth

There are many ways to view Net Worth. Some view it as selling everything they own, paying off everything they owe, and standing in the street with the shirt on their back. Others choose not to include their house or assets that they have no intention of selling or using for future investments. Your Personal Finance Manager will walk you through how to best view Net Worth based on your personal needs and vision, and help you select the accounts you want to include, monitor, and watch as your Net Worth grows.

Step three: Map your cash flow

Where does your money come from? And where does it go? You’ll be able to answer those questions in this step by selecting the accounts that you use to live your everyday life. These are the bank and credit card accounts you use to:

- Deposit your income

- Pay your bills

- Spend on gas, food, and entertainment

- Put money away for special future spending like vacations and holidays

- Send money to investments to grow your wealth

Once these accounts are selected, your Personal Finance Manager will download and categorize your transactions from the last 90 days so that you can easily see how they represent your current lifestyle. Your Dashboard will provide you with the real-time information necessary to make day-to-day decisions with confidence.

Step four: Plan

You’re ready to design your future. Your Cash Flow Plan allows you and your Personal Finance Manager to set targets that will help you meet objectives along the way. Your Dashboard will now provide you with the real-time information necessary to make day-to-day decisions that are aligned with your goals.

Step five: Create your cash flow blueprint

Get a visual picture of how money is flowing in and out of your accounts so you can put your cash flow on autopilot. Cash Flow Blueprint helps you to:

- Identify and close unnecessary accounts

- Automate your cash inflows and outflows

- Optimize your cash flow logistics so that money flowing in and out of your accounts is organized and predictable

Step six: Manage your investments

This is where you and your Personal Finance Manager bring together all the aspects of each one of your investments. LifeStyle Plan allows you to track several investment types including: Brokerage accounts, Retirement accounts, Real estate, and Business Interests.

We use an Investment Top Sheet for each investment and allow you to attach the asset or assets associated with the investment and any related liabilities.You can also enter the Facts, Assumptions, and any actual transactions from accounts that are electronically connected. With all of your investments and their relative performance in one place, you can make better asset allocation and investment related decisions.

Step seven: Create your Life Time Machine

Take a peek into the future of your finances with Life Time Machine, our platform’s most dynamic and interactive feature.

See how all the components of your financial life work together for the rest of your plan years. Just choose a future year and the Life Time Machine will transport you there, where you’ll be able to:

- Make a change to your Cash Flow Plan

- Make an investment change

- Add a Life Time Event like a wedding or inheritance

Once you make a change, the Life Time Machine does all the math for you and shows you the results of your “what if” scenarios. The Life Time Machine really allows you and your Personal Finance Manager to understand cash flow, set goals, and consider the possibilities as you live your todays and plan your tomorrows.